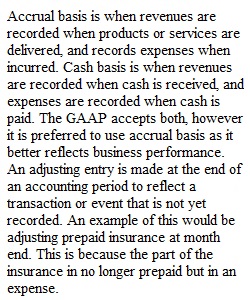

Q Chapter 3 - Weekly Discussion 1. Explain the difference between accrual basis and cash basis accounting? Which one is GAAP accepted? 2. What are adjusting entries? Give at least two different examples of adjusting entries. RUBRIC: **5 points are awarded for a post that correctly and the answer with proper punctuation and grammar. This post is typically is a full paragraph with at least 5-8 sentences. Sources, including textbook, are cited. **3 points are awarded for a post that is "mostly" correct and complete with proper punctuation and grammar. This post is typically close to a full paragraph with at least 3-5 sentences. **1 point is awarded for a post that is incorrect and/or incomplete. **0 points are awarded to those that do not answer the question

View Related Questions